betterment tax loss harvesting cost

Betterment Tax Loss Harvesting Reddit. Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000 20000 you can reduce.

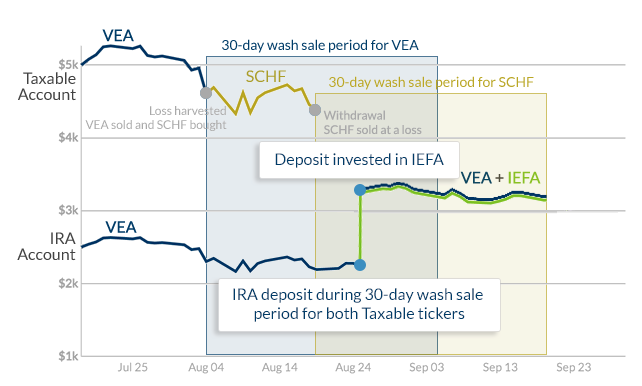

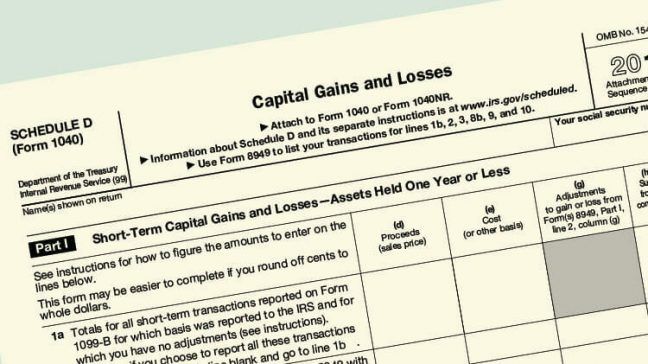

Realized losses on investments can offset gains and reduce ordinary taxable income by as much as 3000 per year.

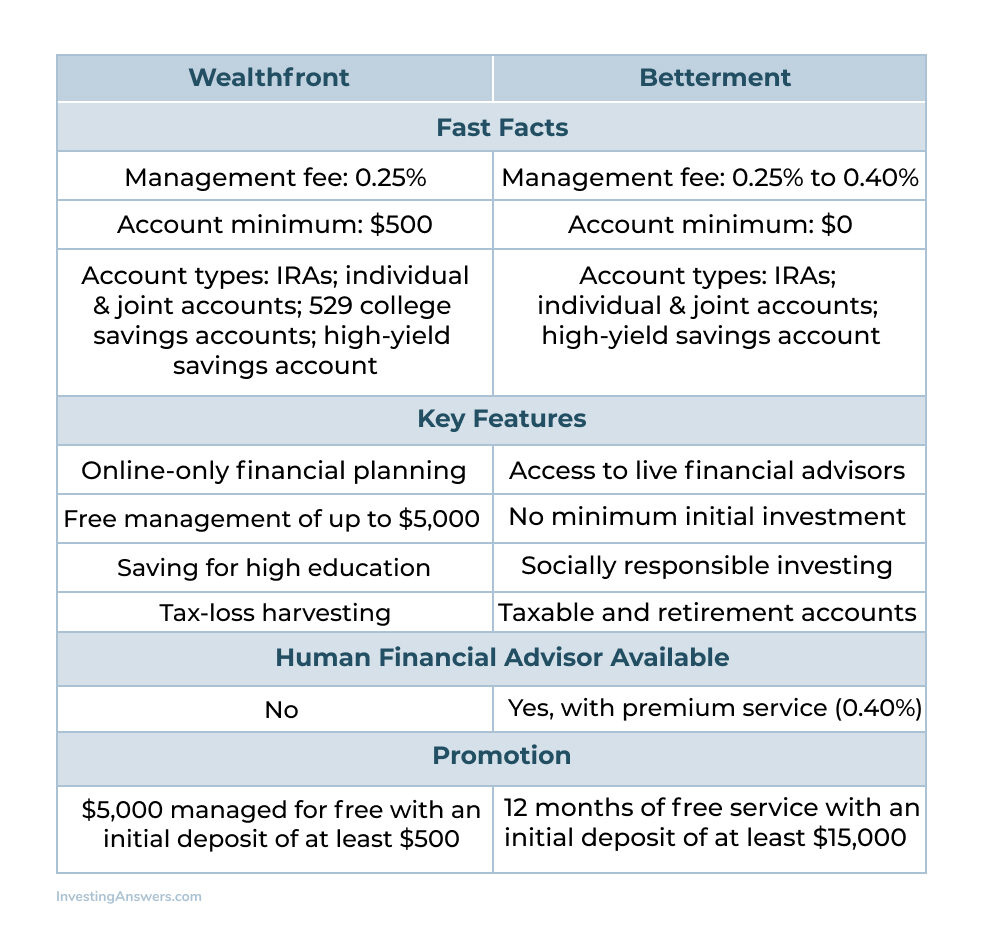

. Tax Loss Harvesting is automated and available. This exceeds the cost of betterments25. Betterment offers two subscription plans for investors.

The sold security is replaced by a similar one maintaining an optimal asset allocation and. General repair or maintenance to sustain an assets current value is not considered betterment and those. Betterment Tax Loss Harvesting Cost.

The amount of gain or loss is equal to the net proceeds of the sale minus the cost basis. My 401k is at Fidelity and my wifes 401k is at Schwab. Does anyone have watch outs or Advertisement.

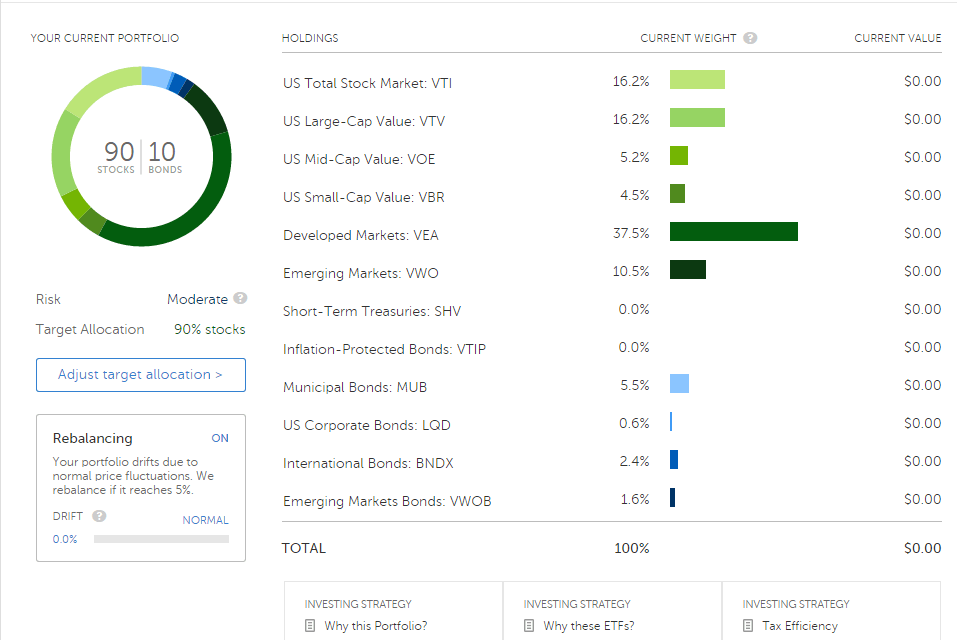

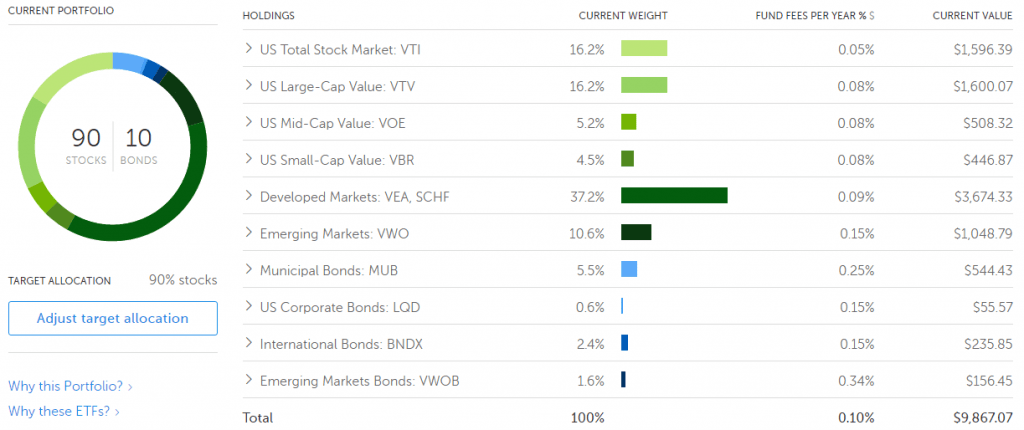

My wife and I use Betterment a roboadvisor to manage our IRAs. How much money does tax loss harvesting save. The digital plan has no minimum account size requirements and holds a 025 annual fee.

A bit of a random question. What is tax loss harvesting betterment. Enabled by computer algorithms tax-loss harvesting can reduce ordinary taxable income by 3000 per year.

This year we would like to start investing into taxable. I want to convert my traditional IRA to a Roth IRA and will have to pay taxes on the gains all the contributions were post-tax. A betterment tax coordinated.

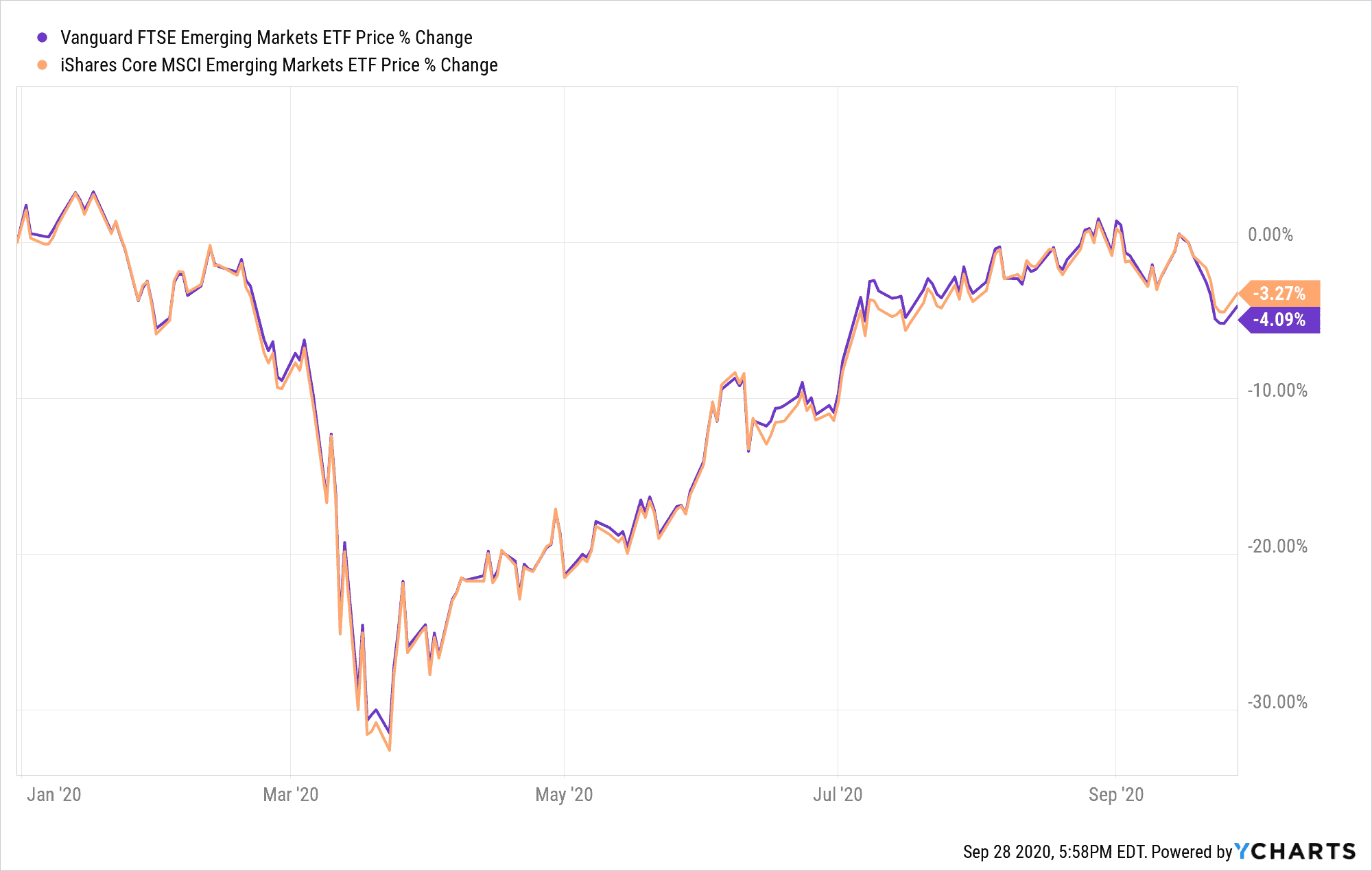

Im considering rolling over my Roth from betterment to Vanguard since it doesnt do tax loss harvesting anyways. By lowering tax exposure this strategy can help you increase gains. Rebalancing helps realign your asset allocation for a balance of.

Tax loss harvesting can be done in 1 minute every ten years or so if one really needs to and its really delaying taxes which is most probably not worth paying 025 in fees. Im looking at a tax bill of roughly 6k. One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio.

Betterment estimates that its tax-loss harvesting feature boosts after-tax returns about 077 percent per year. That may seem modest but over time it can add up to tens of thousands of.

Betterment Review 2022 A Robo Advisor Worth Checking Out

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Betterment Drops Account Minimums On Custom Portfolios Financial Planning

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Should I Invest My Money With Betterment In 2021

Better Investing With Betterment

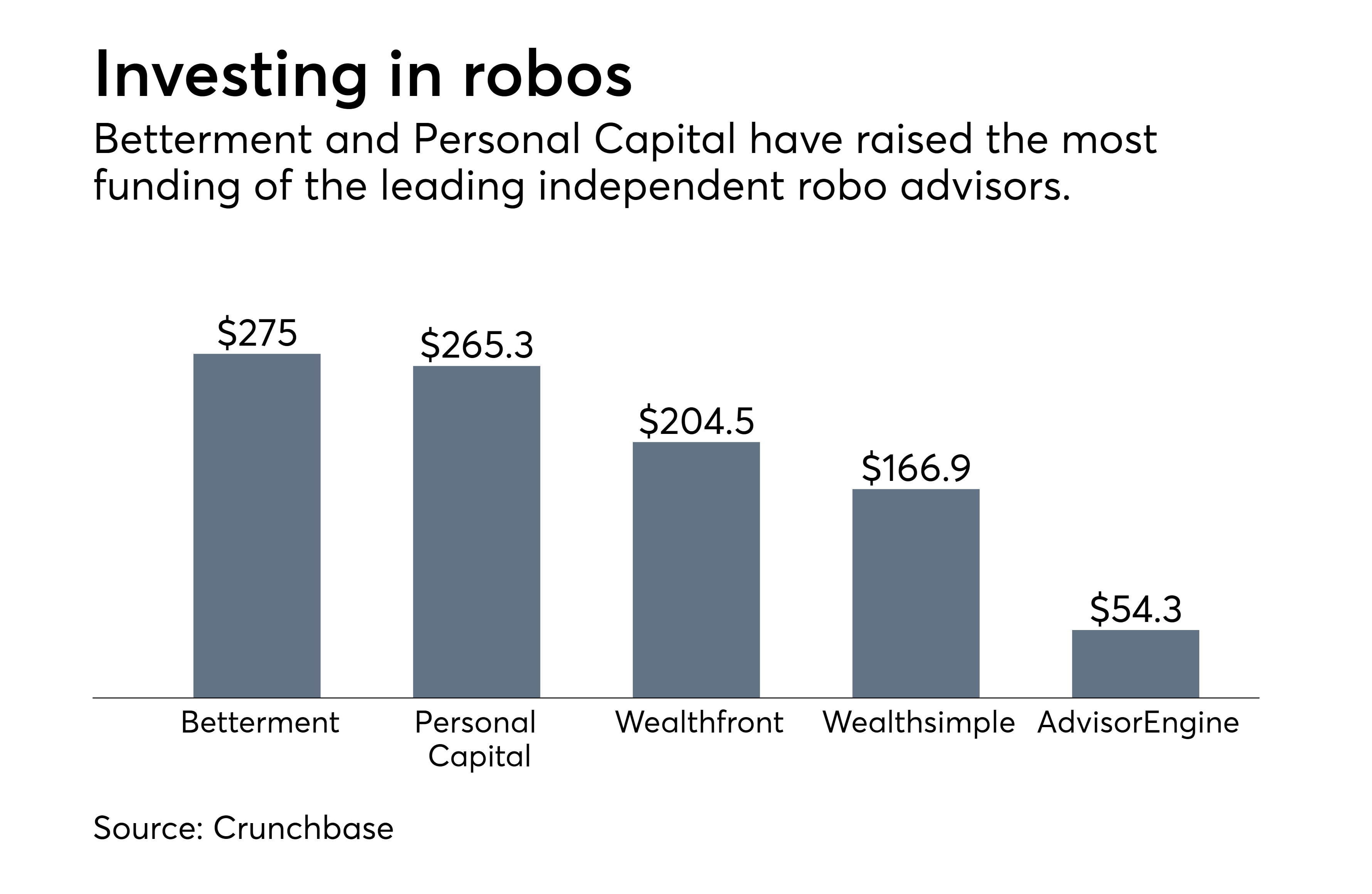

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks

Is Betterment Safe Find Out In This Betterment Review 2022

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

How Much Could You Be Losing To Fees

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Everything We Learned About Investing Was Wrong That S Why We Need Betterment Frugaling

Betterment Review Is This Robo Advisor Right For You

Betterment Review 2022 Pros Cons Features

10 000 And 1 Year With Betterment Performance And Cost

Owning Vti At Both Vanguard And Betterment Jordan Burnett

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review Customized Asset Allocation Human Financial Advisors My Money Blog